Capital One Eno Review: Your Shield Against Online Fraud?

In today’s digital age, online security is paramount. With increasing instances of fraud and data breaches, consumers are constantly seeking tools to protect their financial information. Capital One’s Eno, a virtual assistant designed to safeguard online transactions, has emerged as a popular solution. This Capital One Eno review will delve into its features, benefits, and drawbacks, providing you with a comprehensive understanding of whether it’s the right security tool for you.

What is Capital One Eno?

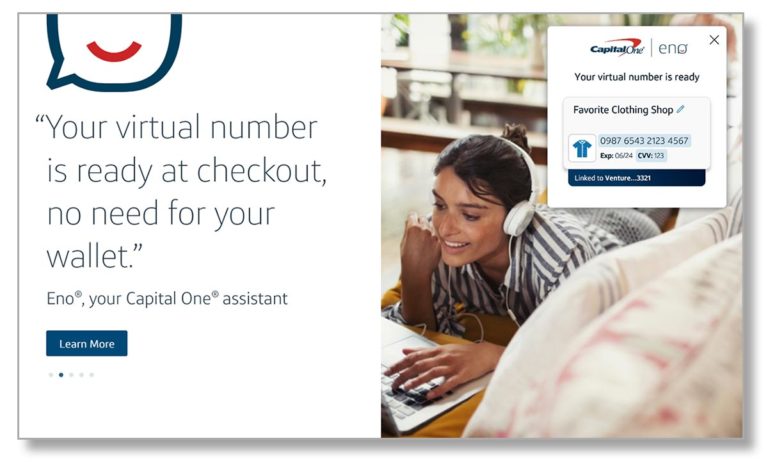

Capital One Eno is a free virtual assistant offered by Capital One to its cardholders. It’s designed to monitor online purchases and generate virtual card numbers for safer online shopping. By masking your actual credit card details, Eno helps prevent fraud and unauthorized access to your account.

Think of it like this: instead of using your primary credit card number every time you shop online, Eno creates a unique, temporary number. If that virtual number is compromised, your actual credit card remains safe. This is a significant advantage in a world where data breaches are becoming increasingly common.

Key Features of Capital One Eno

Virtual Card Numbers

This is Eno’s primary function. When shopping online, you can use the Eno browser extension or mobile app to generate a virtual card number. This number is linked to your Capital One credit card but isn’t the same as your actual card number. If a merchant’s website is compromised, only the virtual card number is exposed, protecting your real credit card information.

Real-Time Transaction Alerts

Eno provides real-time alerts for your Capital One transactions. You’ll receive notifications for purchases, declined transactions, and other account activity. This immediate feedback allows you to quickly identify and report any suspicious activity.

Balance Monitoring

Eno lets you quickly check your Capital One account balances. You can use the Eno app or browser extension to view your available credit and recent transactions. This feature helps you stay on top of your spending and avoid overspending.

Easy to Use Interface

Capital One has designed Eno with user-friendliness in mind. The browser extension and mobile app are intuitive and easy to navigate. Generating a virtual card number takes just a few clicks or taps. The clear and concise design makes it accessible to users of all technical skill levels.

Text Message Alerts and Commands

You can interact with Eno via text message. Send commands like “BALANCE” or “RECENT TRANSACTIONS” to get quick information about your account. You’ll also receive alerts for suspicious activity and large purchases via text. This accessibility makes it easy to manage your account on the go.

Benefits of Using Capital One Eno

- Enhanced Security: The primary benefit of Eno is enhanced online security. By using virtual card numbers, you reduce the risk of your actual credit card information being compromised.

- Fraud Prevention: Eno’s real-time transaction alerts help you quickly identify and report fraudulent activity. This can save you time and money in the long run.

- Convenience: Eno is easy to use and integrates seamlessly with your online shopping experience. Generating virtual card numbers is quick and convenient.

- Free Service: Capital One Eno is a free service for Capital One cardholders, making it an accessible and valuable tool for anyone looking to improve their online security.

- Peace of Mind: Knowing that your credit card information is protected can provide peace of mind when shopping online.

Potential Drawbacks of Capital One Eno

- Limited to Capital One Cardholders: Eno is only available to Capital One credit cardholders. If you don’t have a Capital One card, you can’t use Eno.

- Not Accepted Everywhere: While most online merchants accept virtual card numbers, some may not. This can be frustrating if you encounter a website that doesn’t support Eno.

- Potential for Confusion: Managing multiple virtual card numbers can be confusing. It’s important to keep track of which virtual number you used for each purchase.

- Reliance on Capital One: Your online security is dependent on Capital One’s security measures. If Capital One’s systems are compromised, your virtual card numbers could be at risk.

Capital One Eno: How it Works

Using Capital One Eno is straightforward. Here’s a step-by-step guide:

- Download and Install: Download the Eno browser extension or mobile app from the Capital One website or your app store.

- Log In: Log in to your Capital One account through the Eno app or browser extension.

- Shop Online: When you’re ready to make an online purchase, click the Eno icon in your browser or open the Eno app.

- Generate a Virtual Card Number: Eno will generate a virtual card number for you. You can customize the spending limit and expiration date for the virtual card.

- Enter the Virtual Card Number: Enter the virtual card number, expiration date, and security code on the merchant’s website.

- Complete Your Purchase: Complete your purchase as usual.

Alternatives to Capital One Eno

While Capital One Eno is a great tool, it’s not the only option for protecting your online transactions. Here are some alternatives:

- Privacy.com: Privacy.com offers a similar service to Eno, allowing you to create virtual card numbers for online purchases. It works with any credit or debit card.

- Credit Card Alerts: Many credit card companies offer real-time transaction alerts. These alerts can help you quickly identify and report fraudulent activity.

- Strong Passwords and Two-Factor Authentication: Using strong passwords and enabling two-factor authentication on your online accounts can help protect your personal information.

Is Capital One Eno Right for You?

Whether Capital One Eno is right for you depends on your individual needs and preferences. If you’re a Capital One cardholder looking for a free and easy way to enhance your online security, Eno is definitely worth considering. The virtual card number feature and real-time transaction alerts can provide significant peace of mind.

However, if you’re not a Capital One cardholder or if you prefer a solution that works with all of your credit cards, you may want to explore alternatives like Privacy.com. [See also: Best Credit Cards for Online Shopping]

Capital One Eno Review: A Final Verdict

In conclusion, Capital One Eno is a valuable tool for Capital One cardholders who want to protect their online transactions. Its virtual card number feature, real-time transaction alerts, and easy-to-use interface make it a convenient and effective way to prevent fraud. While it’s not a perfect solution, its benefits outweigh its drawbacks for most Capital One customers. This Capital One Eno review highlights its strengths and weaknesses, allowing you to make an informed decision about whether to use this service.

Ultimately, the decision of whether to use Capital One Eno comes down to your individual needs and risk tolerance. If you’re concerned about online security and you’re a Capital One cardholder, Eno is a great tool to have in your arsenal. It offers a simple and effective way to protect your financial information and shop online with confidence. Remember to always stay vigilant and monitor your accounts for any suspicious activity, regardless of the security measures you have in place. Using Capital One Eno is a proactive step towards a safer online experience. Consider this Capital One Eno review as a starting point for your own research and exploration of online security tools.

This Capital One Eno review aims to provide a balanced perspective, helping you understand the benefits and limitations of this tool. By understanding how Capital One Eno works and what it offers, you can make an informed decision about whether it’s the right choice for your online security needs. The features of Capital One Eno are designed to safeguard your financial information in an increasingly vulnerable digital landscape.

The Capital One Eno review emphasizes that while Capital One Eno provides an additional layer of security, it’s not a substitute for good online habits. Always be cautious about the websites you visit and the information you share online. Regularly review your credit card statements and report any suspicious activity immediately. By combining the use of Capital One Eno with responsible online behavior, you can significantly reduce your risk of becoming a victim of online fraud. The positive aspects highlighted in this Capital One Eno review underscore its value as a security tool.